Invest in Stablecoins in 2025 Full Guide

You should familiarise yourself with these risks before trading on margin. Get exposure to multiple assets from just a single trade with exchange traded funds (ETFs). The highest risks are found in high-yield products (like Dual Investment or liquidity farming), but Binance uses SAFU, reserves audits, and multi-layered security to protect users. Flexible products typically offer 2 – 6% annual yield, while staking or Dual Investment can pay even more.

Requirements for wallet providers

However, this was intended to be temporary, and our most recent adjustment — reducing Slope 1 and UOptimal — has not created any additional rate volatility. Following our previous updates to the WETH Core market IR curve, we are now proposing another adjustment to align more closely with current market conditions. As detailed in our previous updates, these parameters were introduced to address sustained high utilization and rate volatility stemming from HTX-linked outflows that reduced supply. Our prior adjustment increased Slope 1 from 2.7% to 3.0% and raised UOptimal to 95%. This change was intended to flatten the interest rate curve and reduce volatility above optimal utilization during a period of elevated outflows and market instability. The steeper slope 1 helped temper the borrow demand until additional supply was deposited by introducing stronger rate pressure on borrowers.

Full Functionality of Binance Earn in 2025 – 2026

Once the fee is paid the scammers either cease communication or provide fake updates and reports. Scammers have found ways to make money by creating fake cryptocurrencies or hyping an existing currency by offering buyers a chance to get in on the ground floor of an ICO. Once they have enough investors, they will disappear with all of the ‘invested’ funds, leaving investors with nothing.

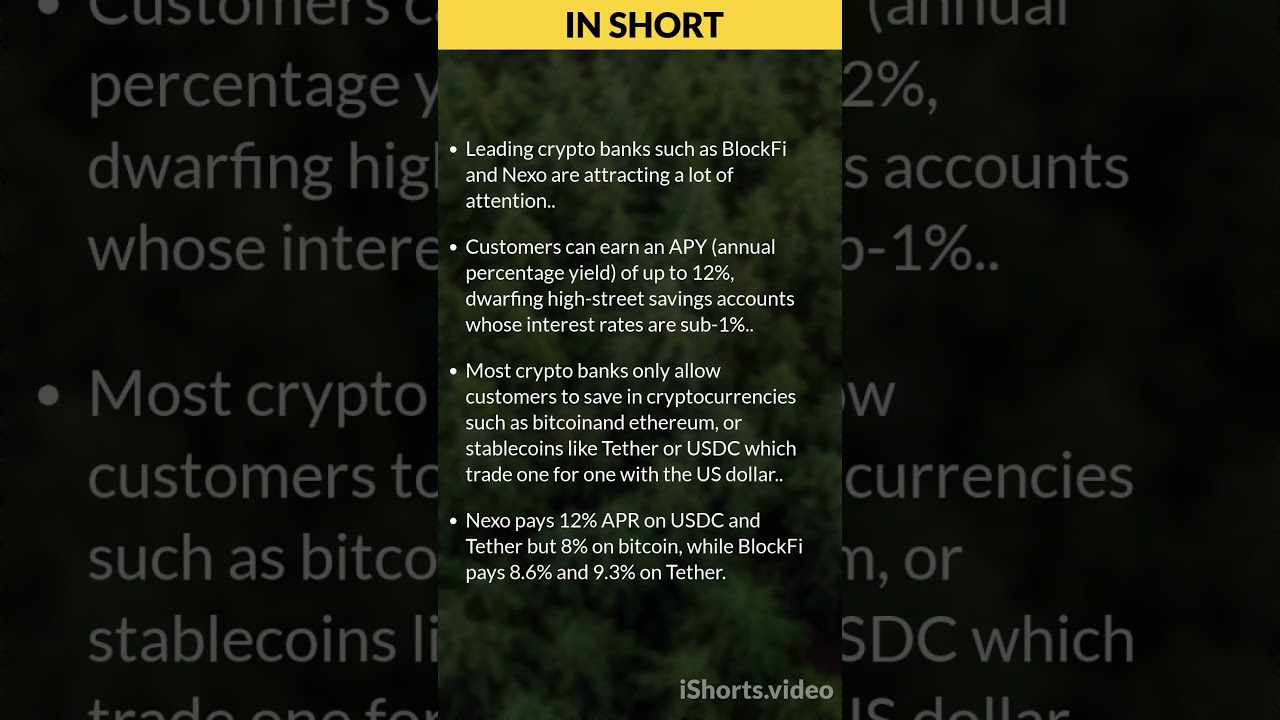

Check your account balance, view your trade history, deposit and withdraw funds and more. AaveAave is a versatile DeFi protocol for crypto loans, including stablecoin options. It offers fixed-interest rate loans, uncollateralized flash loans, and regular crypto loans. Additionally, Nexo provides $375 million in insurance coverage for custodial assets, attracting conservative investors.Please note that Nexo no longer accepts customers from the United States. NexoNexo supports various tokens and offers attractive APYs, including up to 17% for stablecoins like USDT, with earnings in Nexo tokens. The first of the three stablecoins it introduced to the market was the USDT.

- Binance Earn offers several products for different earning styles and risk profiles.

- Stablecoins are likely to play an increasingly important role in currency markets and digital transactions.

- Wherever in the world your loved one is, get notified via email when they access their funds, so you can rest assured your money is where it needs to be.

- In doing so, they undertake liquidity and maturity transformation, which exposes them to credit, liquidity and market risk.

Earn an annualised yield of up to 15% through Binance Lending

This may include your name, contact details (including, if provided, details of the organisation you work for), and opinions or details offered in the response itself. The Bank welcomes responses to any questions but does not expect respondents to provide an answer to every question. We are keen to hear from a wide range of stakeholders, which includes community or charitable-focused organisations, the payments industry, businesses, and the general public. Issuers would be required to have adequate organisational arrangements (internal governance and controls) in place, which mitigate the risk of misapplying or mismanaging the backing assets, fraud, inadequate record keeping, or negligence. The segregation of backing assets, and coinholders’ rights to those ‘segregated assets’, are critical to ensuring that coinholders can redeem in full at all times. The Bank has considered two legal models – a debt model and a trust model – for protecting coinholders’ rights and satisfying the FPC’s second expectation (Table 5.1).

Rather, the Bank’s objective is to maintain financial stability by ensuring that risks are managed and mitigated to an appropriate degree and that any failure of an issuer is orderly. The risks of backing liabilities with commercial bank deposits became evident following the collapse of Silicon Valley Bank (SVB) in March 2023. Circle, the US-based issuer of the stablecoin ‘USDC’, held US$3.3 billion (around 9%) of its backing assets as deposits with USDT APY SVB.